The Princeton

Adaptive Premium Fund

Fund Overview

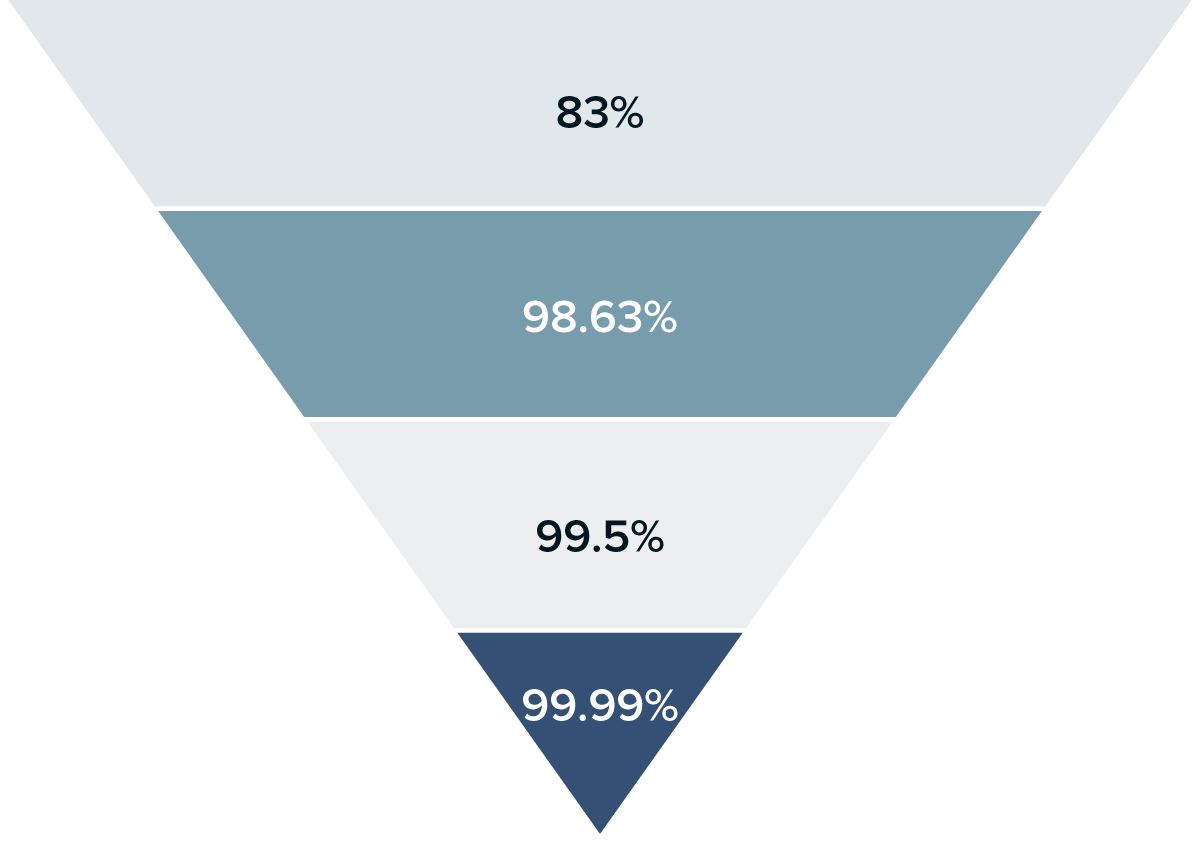

The Princeton Adaptive Premium Fund seeks to use risk models in the selling of market hedges in the form of S&P 500 put options to collect premium. The strategy utilizes option contracts to attempt to generate a weekly profit. By utilizing historical market data, along with various current risk data points, the Fund seeks to take advantage of the difference between perceived and real risk in financial markets on a weekly basis. The Fund’s goal is to deliver compelling, non-correlated absolute returns.

Objective

- The Fund’s primary objective is capital appreciation with a secondary objective of providing income.

Investment Approach

- The Fund's goal is to collect small amounts of premium each week by selling put options on the S&P 500 (SPX) that typically have a six to eight day time frame to expiration.

- Seeking to limit risk, the Fund will purchase a put option on the same S&P 500 (SPX) contract with the same terms other than the strike price.

- The Fund's goal is to deliver compelling, non-correlated absolute returns.

Organizational Structure

- 1940 Act registered open-end mutual fund

- Tickers: PAPIX, PAPAX

- Daily liquidity

- Form 1099 tax reporting

Strategy Overview

1Source: Bloomberg. From 1/1/1990 to 12/31/2023

2Source: Bloomberg. From 1/1/1950 to 12/31/2023

Performance

The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Past performance is no guarantee of future results. The Fund’s total annual operating expenses are 88.13% and 87.88% for the Class A and I shares, respectively. The Fund’s investment advisor has contractually agreed to waive management fees and to make payments to limit Fund expenses until at least January 31, 2024. After this fee waiver, the expense ratios are 2.62% and 2.37% for the Class A and I shares, respectively. These fee waivers and expense reimbursements are subject to possible recoupment from the Fund in future years. Please review the Fund's Prospectus for more detail on the expense waiver. The maximum sales load for the Class A shares is 5.75%. A fund's performance, especially for very short periods of time, should not be the sole factor in making your investment decisions. For performance information current to the most recent month-end, please call toll-free (888) 868-9501.

Management

Princeton Fund Advisors, LLC together with its affiliates, manages approximately $3.0 billion of assets for institutional and private clients worldwide (As of 12/31/2023). Princeton Fund Advisors, LLC is a Registered Investment Advisor ("RIA") with the SEC. The firm's two Investment Committee Members contribute more than 60 years of alternative asset management experience to the portfolio construction and management process. The Company has offices in Colorado, Minnesota, and Florida. Princeton Fund Advisors, LLC serves as Advisor to the Fund.

Greg Anderson

Prior to founding Princeton Fund Advisors, LLC and its affiliated entities, Mr. Anderson was a Senior Vice President and Managing Director of Investment Manager Search, Evaluation, and Due Diligence at Portfolio Management Consultants, Inc. Mr. Anderson was previously employed with Deloitte & Touche where he specialized in the areas of estate planning, health care and non-profit organizations, and tax and personal finance planning for high net worth individuals. Mr. Anderson holds a B.A. degree from Hamline University in Minnesota and a J.D. from the University of Minnesota School of Law. Mr. Anderson is a Certified Public Accountant (inactive).

John Sabre

Prior to founding Princeton Fund Advisors, LLC and its affiliated entities, Mr. Sabre was a Senior Managing Director at Bear Stearns & Co. and Head of the Mezzanine Capital Group. Mr. Sabre previously served as President of First Dominion Capital, which managed $3.0 billion of assets and is now owned by Credit Suisse First Boston. Prior to his position at First Dominion Capital, Mr. Sabre was a Managing Director and founding partner of Indosuez Capital, the merchant banking division of Credit Agricole Indosuez. Mr. Sabre holds a B.S. degree from the Carlson School at the University of Minnesota and an M.B.A. degree from the Wharton School at the University of Pennsylvania

Zachary Slater

Mr. Slater joined Mount Yale and its affiliated entities in 2011 to conduct and oversee research on new investment opportunities. His experience includes evaluating and monitoring traditional, alternative and private investment strategies. Additionally, he has experience transitioning strategies into different investment vehicles. Mr. Slater is responsible for sourcing new managers, conducting due diligence on potential managers and ongoing monitoring of current managers and investments. He holds a B.S. from the Daniels College of Business at the University of Denver.

Fund Facts

| Share Class | Ticker | CUSIP | Investment Minimum* | AIP/AWP & Subsequent Minimum | Redemption Fee | Management Fee | Class Structure | 12B-1 Fee | Inception Date |

|---|---|---|---|---|---|---|---|---|---|

| A Share | PAPAX | 66538J449 | $2,500 | $100 | NONE | 1.50% | 5.75% Load* | 0.25% | 9/23/2022 |

| I Share | PAPIX | 66538J423 | $100,000 | $100 | NONE | 1.50% | No Load | None | 9/23/2022 |

| Role | Organization |

|---|---|

| Investment Advisor | Princeton Fund Advisors, LLC |

| Administrator/Transfer Agent/Fund Accountant | Ultimus Fund Solutions, LLC |

| Outside Counsel | Thompson Hine LLP |

| Custodian | U.S. Bank |

| Distributor | Northern Lights Distributors, LLC |

| Auditor | RSM US LLP |

*The load and investment minimum may be waived at the discretion of the advisor.